Solar Solutions Tailored for

Farms in New Jersey

Get 40-90% of your solar investment back the first year

Clean Energy Advisor 4 U :

Your Premier Choice for Agricultural Solar Solutions in New Jersey

You Work Too Hard to Throw Money Away on Your Farm in New Jersey!

Like many farmers, you may find yourself overspending thousands of dollars on electricity, putting unnecessary strain on your bottom line and leaving it susceptible to escalating utility rates from New Jersey providers like JCP&L, PSEG, Rockland Electric and Atlantic City Electric.

As of June 1st, 2024 NJ Utilities are raising rates again anywhere from 3.6% to 8.6%.

By investing in a solar energy system , you can generate immediate savings and safeguard your farm against future increases in energy costs.

Partner with us, and we'll help you reclaim up to 90% of your farm solar system costs in the first year through Federal and New Jersey tax incentives and grants.

Farms Present a Unique Opportunity for Solar Energy Integration

Farms typically exhibit high energy consumption, driven by the operation of industrial-scale agricultural equipment and additional needs such as lighting for barns or stables. Furthermore, the presence of barns and multi-use buildings on the property makes them ideal structures for solar installations, aligning well with the overall electricity demand of the farm.

Using Solar as a Duel Purpose on

Your Farm

A ground-mounted solar system on a farm can serve a dual purpose, offering an innovative approach to agricultural practices. Allowing sheep to graze among the solar panels has emerged as an appealing solution. Additionally, planting groundcover to support pollinators, cultivating marketable crops like lettuce and broccoli under the panels, installing beehives, and implementing soil health practices to enhance the land for future agricultural use are all part of this integrated approach. Scientific studies have demonstrated that certain crops thrive when grown in this manner. Projects that combine farming and solar energy are commonly referred to as agrivoltaic initiatives.

Regardless of your farm's size, Clean Energy Advisor 4 U is committed to guiding you through the full spectrum of grants and incentives available for your benefit.

Solar installations on farms are distinctive, often qualifying for various commercial programs. Opting for solar energy through the farm's business operations unlocks access to numerous commercial incentives, including the Federal Solar Tax Credit, Solar Depreciation Credit, and NJ Solar Renewable Energy Certificates provided by NJ Clean Energy. Additionally, farmers are eligible for grants from entities such as the USDA and the NJEDA.

The Federal tax credit for commercial solar serves as a significant incentive for farming and agricultural businesses looking to leverage solar investments. In essence, businesses can benefit from a tax credit equal to 30% of the total cost of purchasing solar panels. An additional 10% tax credit is available if the solar panels are manufactured in the United States, further enhancing the overall incentive.

Farms can take advantage of accelerated depreciation for their solar investments. In the initial year, 60% of the cost basis is eligible for depreciation on federal taxes, with the remaining 40% following the five-year Modified Accelerated Cost Recovery System (MACRS) schedule. State depreciation similarly aligns with the five-year MACRS schedule.

The USDA REAP grant is an excellent chance for qualifying rural businesses and farmers to install solar. This competitive grant has the potential to cover up to 50% of your installation cost, with a maximum funding amount of $1 million.

The NJ Economic Development Authority (NJEDA) Small Business Improvement Grant provides reimbursement for costs associated with making building improvements or purchasing equipment. Reimbursement of up to 50% of total project costs incurred up to $50,000. Only one award is allowed per EIN for the life of the program.

New Jersey is committed to supporting solar energy. The Successor Solar Incentive (SuSI) Program is the current solar program which allows new solar projects to register to earn New Jersey Solar Renewable Energy Credits II (SREC-II)

This calculates to tens of 1000's of dollars over 15 years for generating your own electricity!

With our partner SunStone Credit

We are able to offer 100% Financing

Flexible Terms from 5 to 20 years

Scalable sizes from $50K to $5m

100% Financing - No Money Down

No real property liens- the only loan collateral is the solar system itself.

So is solar a good investment

for my farm in NJ?

Let's do some math on a $150,000 system cost

Cost of solar system installed $150,000

minus Fed Tax Credit (30%) -$45,000

minus USA made equipment (10%) -$15,000

minus NJEDA Grant (50% up to $50K) -$50,000

minus USDA REAP Grant (50%) -$75,000

minus 1st yr Depreciation -$17,000

Total Deductions = $151,500 $1,500 in your pocket

Additional Income for Generating your own electric with

NJ SREC program over 15 years $82,500

This is just an example. Your costs and savings may vary on system size, placement, shading, etc.

Please consult your tax advisor regarding your individual tax situation and income tax credit eligibility.

Like to see an estimate of your

solar system size, cost and savings

for your farm?

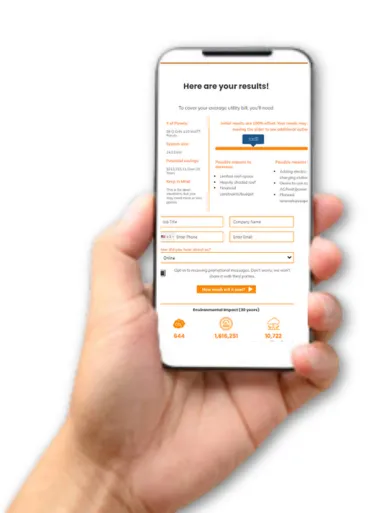

Discover Your Savings With Our Solar Power Calculator

Use our solar calculator to see how solar can help you. We'll provide

you with:

A 30-year Cost Breakdown

Cumulative Cash Flow

Payback, ROI and Environmental Savings

Get Started Today

Let’s talk about potential solar opportunities for your farm or Agribusiness. We offer free, no obligation quotes to get you started on your solar journey.

For nearly a decade, we've been delivering top-notch solar and electrical solutions to residences and businesses, regardless of their scale or type. Our family-operated enterprise prioritizes economical solar setup and upkeep, offering a refreshing alternative to the expensive, sales-centric methods commonly seen in the solar energy industry.

SOLAR SERVICES